Things by their name

Bitcoin chain analysis

How to protect your privacy when using Bitcoin

Bitcoin is a public and transparent network where the record of transactions is public, which has led to the emergence of “blockchain analytics” companies and entities that have created a need for users to protect their privacy.

Because the Bitcoin network is pseudonymous and not anonymous, users should avoid exposing their real identity to be associated with their address, as any third party observer could potentially access this information. Maintaining privacy while using Bitcoin requires paying attention to how transactions are constructed; what entries are being used and what has been the full history of these entries, since if an address is exposed, it can be quickly assumed that the history of that transaction belongs to the same owner. So today we are going to look into the top five methods that an analyst could use to link your Bitcoins to a single identity.

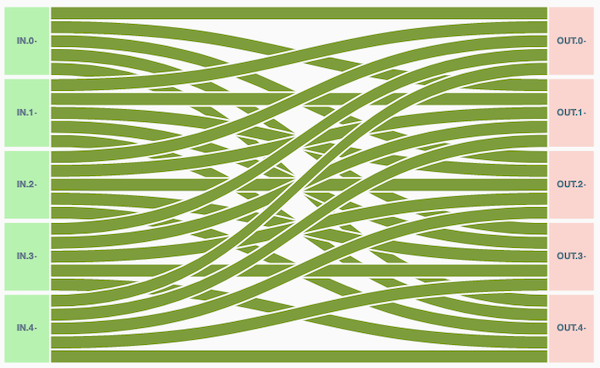

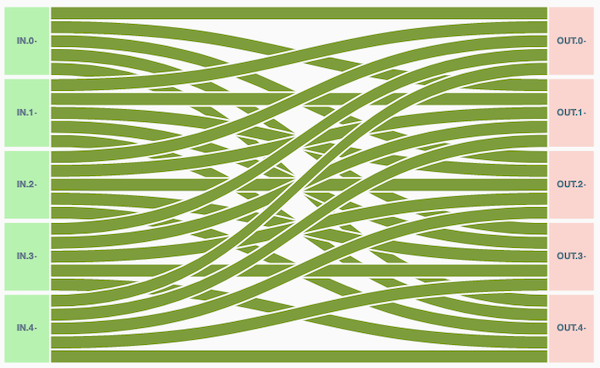

When a user is going to perform a transaction and the user’s wallet does not have a single transaction with sufficient balance to satisfy the full amount of the payment, wallets usually try to use multiple entries in the transaction. When this happens, a malicious player may be able to resort to the common ownership heuristic, that is, he can assume that all the entries used in the transaction are from the same owner.

It is a good practice to use a new Bitcoin address each time a new payment is received. This allows to isolate each transaction in a way that it is not possible to associate them with each other, so people who send money to one of them will not be able to see which other Bitcoin addresses are being used and what is happening with them. Of course, it is important that amounts received at different addresses are never mixed in a single address later, as this would reveal that all the addresses belonged to the same owner.

An experienced analyst can determine which software created a particular transaction, since each of the different wallet applications create transactions with small differences from each other. This wallet fingerprint can be used to detect which of the transaction outputs belongs to the issuer of the transaction.

A lot of the payment amounts are usually round numbers, e.g. 1 BTC or 0.1 BTC, which means that the amount of change remaining usually will be a non-round number (e.g. 0.78213974 BTC). This is potentially useful to find the direction of exchange, i.e. the outgoing transaction that is not a round number. This also applies to amount that, in value of another currency such as USD or EUR, is a round number.

RBF is a mechanism to replace an unconfirmed transaction with one that pays a higher commission rate in order to increase the speed of confirmation. When this is done the tendency is to increase the miner fee by reducing the amount of the change, so if an analyst is looking at all unconfirmed transactions, it can be concluded that the outgoing direction of change is the one for which the amount has been reduced after RBF is applied.

Things by their name

The differences between each of the existing types

Road to 64 blockchains

@2024 BLOCKLOOP